IS YOUR MORTGAGE UP FOR RENEWAL?

Let's look at all your options, so you can get the best mortgage product for you.

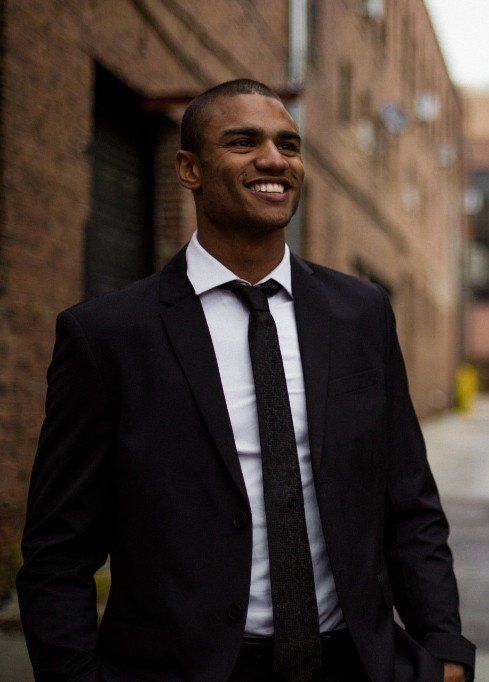

YOUR NAME

This is where we will include a personalized heading for you.

Here's where your bio will go. Typically a good bio will be no more than 125 words and focus on how you can help meet your client's needs. If you want more space to share, we will add a button that links to a separate about me page.

If you'd like us to help with your bio, we'll need to know what year you started brokering, your ideal client, and any other fast facts you'd like people to know.

Most clients checking you out online are just wanting to see that you're a real person. As they've been referred by someone you know, they just need a little about you to build some trust.

555-555-5555 | email@email.com | Your Address Here

WHAT TO DO WHEN YOUR MORTGAGE IS SET TO RENEW

Start Early

When your existing mortgage term is set to expire, and your mortgage is ready to renew, you should start looking at your options up to 6 months in advance. Typically your existing lender will send a renewal offer in the mail, you should NOT sign this, instead this is the best tome for you to consider all your options. Give me a call, we can discuss the next steps together.

Look at ALL your Options

Did you know that up to three quarters of Canadians simply sign the renewal letter from their lender without looking for a better deal? Given this, of course the banks won't make you their best offer at the outset. It's all business to them, and they are in the business of making money, from you. Let me take a look at your financial situation, and outline the best mortgage products available on the market.

Switch Lenders

Given your current financial situation, it might make sense to stay with your existing lender. However, it might also make sense to find a new lender; one who has a better mortgage product to suit your needs. As your existing term is set to expire, you can switch to a new lender without paying a penalty and most of the time, the lender will even cover the legal costs to switch your mortgage.

Mortgage Refinance

When your mortgage is up for renewal, not only can you renew with your existing lender, or switch to another lender, but this is a great time to consider a mortgage refinance. Through a refinance, you can access some of the equity that has been built up in your home over the past years. When you refinance at renewal, you save the penalty of breaking your existing mortgage term.

When your mortgage is up for renewal, get in touch and we'll look at all your options together!